How to create an Emergency Fund.

An emergency fund is a peace of mind fund.

It is your first line of defense when unexpected things happen. And one thing is certain: emergencies will happen. We just don’t know when. That’s the variable we need to solve for.

That’s why we want to be proactive and have money set aside, ready to help us out during those unexpected situations.

What is an emergency fund?

It is money set aside that you have easy access to (within 1-2 days), to cover unexpected expenses. Examples are:

Auto repairs.

Major appliances repair or replacement.

Medical expenses.

Loss of employment.

How much should you have in your emergency fund?

I like to split the emergency fund in two buckets:

One for loss of employment.

One for everything else.

Why do I like the two-bucket approach?

If you get laid off and at the same time your furnace breaks and needs to be replaced, I wouldn’t want you stressing out how you will pay your monthly bills plus another $5-7K (or more) to replace your furnace. Being laid off is stressful enough. The goal of having an emergency fund is to provide peace of mind.

To calculate how much you should have, it is a bit of an art and science.

The loss of employment emergency fund is a bit more involved, so let’s tackle the one for everything else first.

If you rent a home, $5,000 may be a reasonable emergency fund goal for when stuff breaks or larger medical expenses that are not covered by insurance, such as deductibles.

If you own a home, $10,000 may be a reasonable goal to shoot for, because one of the “perks” of home ownership is that when things break, you are 100% responsible for the cost of getting them fixed or replaced.

The above amounts are suggestions and will depend on personal circumstances. If you own a home that is $5 million, $10,000 probably won’t cut it. Things in that home will be more expensive to fix/replace.

Additionally, if medical expenses are a concern, increasing the emergency fund and utilizing a Health Savings Account (if available) may be a worthwhile consideration.

Now, back to the loss of employment emergency fund.⤵️

This one will depend on things such as:

Size of household (kids, no kids)

Adults working (single-income household, dual-income?)

Monthly fixed expenses (house payment, loan payments, bills, etc.)

Monthly variable expenses (groceries, dining out, shopping, etc.)

Type of income (stable income, commission based, bonus heavy, equity, etc.)

Type of industry (stable industry, prone to layoffs, etc.)

Keep your full lifestyle during loss of employment or only partial?

Are you able and/or willing to cut back on monthly expenses during loss of income?

What gives you peace of mind?

This one is probably the most important. If we come up with a need for 3 months of an emergency fund, but you feel more comfortable with 6 months, then 6 months will be the more correct number. Now, if you tell me that you need 5 years’ worth of an emergency fund, we may need to have a deeper conversation about inflation and investment allocation. 😁

As you can see, there are many variables that can go into deciding how big your loss of employment emergency fund should be.

A non-personalised rule of thumb is:

If a single-income household, six months may be a good starting point.

If a dual-income household, three months may be a good starting point.

Start with these and customize from there based on your financial plan and goals.

How to build an emergency fund?

You must have a grasp on your Cash Flow.

Cash Flow = Income - Expenses

Knowing your monthly cash flow is crucial to understanding where your money is going, how much your fixed and variable expenses are, and how much is left over for saving and investing goals.

Once you understand your monthly cash flow (I use Monarch Money with my clients*), you can establish a cash flow system.

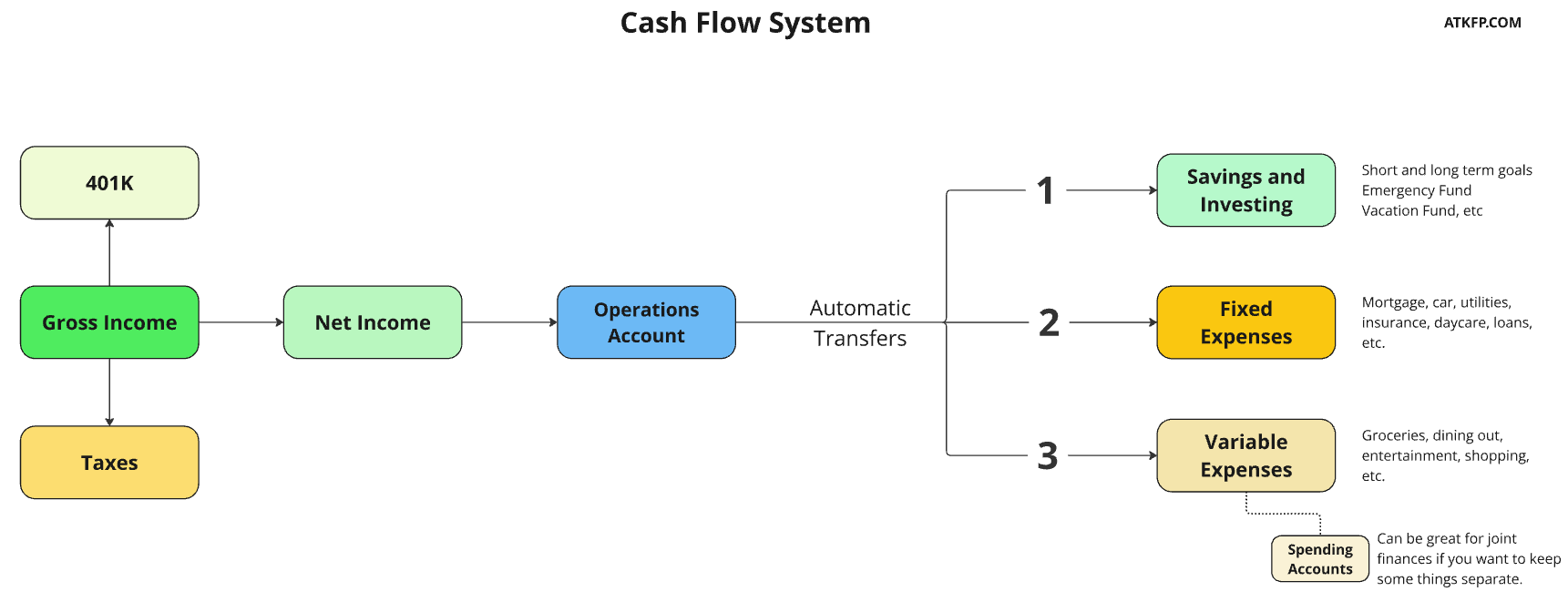

A cash flow system is where you give your dollars specific jobs.

How much goes towards Fixed Expenses?

How much towards Variable Expenses?

How much towards financial goals, such as building an emergency fund?

A generic example of what a Cash Flow System may look like.

Use automation to streamline the flow of money. That’s the “secret”. Remove as much friction as possible. Set up bank transfers, so money moves automatically.

To build an emergency fund, you need discipline and systems in place. Automate it.

Calculate your target emergency fund.

Open up a High-Yield Savings Account.

Set up automatic transfers for each paycheck period.

Keep the transfers until your emergency fund is fully funded.

The above sounds simple, but it is not easy in reality. We know that life always has curveballs and something always comes up. So, monitoring your financial plan continuously is crucial.

Having financial awareness of all of your personal financial matters is key to being able to adjust and be flexible when things happen. An emergency may happen during the time you are building the emergency fund.

So knowing how your money flows will empower you to make well-informed decisions about where the money will come from and where you may need to adjust to cover that expense.

In addition, the below are great opportunities to help you build your emergency fund faster:

A Tax Refund

Bonus

The goal here is to start and automate it. Even if you need to start with $50 a month, that’s perfectly OK. Make a small initial goal of $1,000 and start putting money towards it. Don’t get overwhelmed with “how am I ever going to get to $30,000 for an emergency fund???”

Just start!

Where should you keep your emergency fund?

Please don’t keep it in a regular savings account earning 0.01%. I see it too often. You are losing money to inflation.

As a start, open up a High-Yield Savings Account. They pay way more than 0.01% and they are also federally insured (FDIC) for up to $250,000.

Other tools to consider using for your emergency fund are money market funds, ultra-short treasuries, and short-term CDs.

Benefits of having an emergency fund.

It is your first line of defense against the unknown. Benefits are:

Keeps you out of high-interest debt, such as credit cards.

Lowers your stress during a period of unemployment.

Provides stability during uncertain times, so your other goals stay on track.

When should you use your emergency fund?

Because I have seen this, I feel obligated to say it. The emergency fund is for emergencies only.

It is not for helping to pay for vacations, car maintenance, or an “emergency” shopping spree. These are all known expenses and can be planned for proactively. All it takes is some cash flow planning.

The emergency fund is for unexpected expenses that must be covered.

📧 If you are unsure how to start a Financial Plan or if you want to check that you are heading in the right direction, feel free to reach out.

🗓️ The first two meetings are complimentary and you will walk away with clarity. You can schedule a meeting by clicking on my calendar here.

Feel free to review the Planning Process page to get familiar with what we offer.

Located in Oswego, IL, we serve Naperville, Yorkville, Plainfield, Chicagoland, and nationwide.

*I am not affiliated with Monarch Money and do not receive any kickbacks. I just like the tool and it helps me support my clients with their cash flow planning. Any budgeting tool or spreadsheet can help in understanding your cash flow and budget.