Should you get out of the stock market?

I am writing this blog in November 2025. Talks about an AI bubble and the Government shutdown are all the rage these days.

But the information in this blog applies to every year.

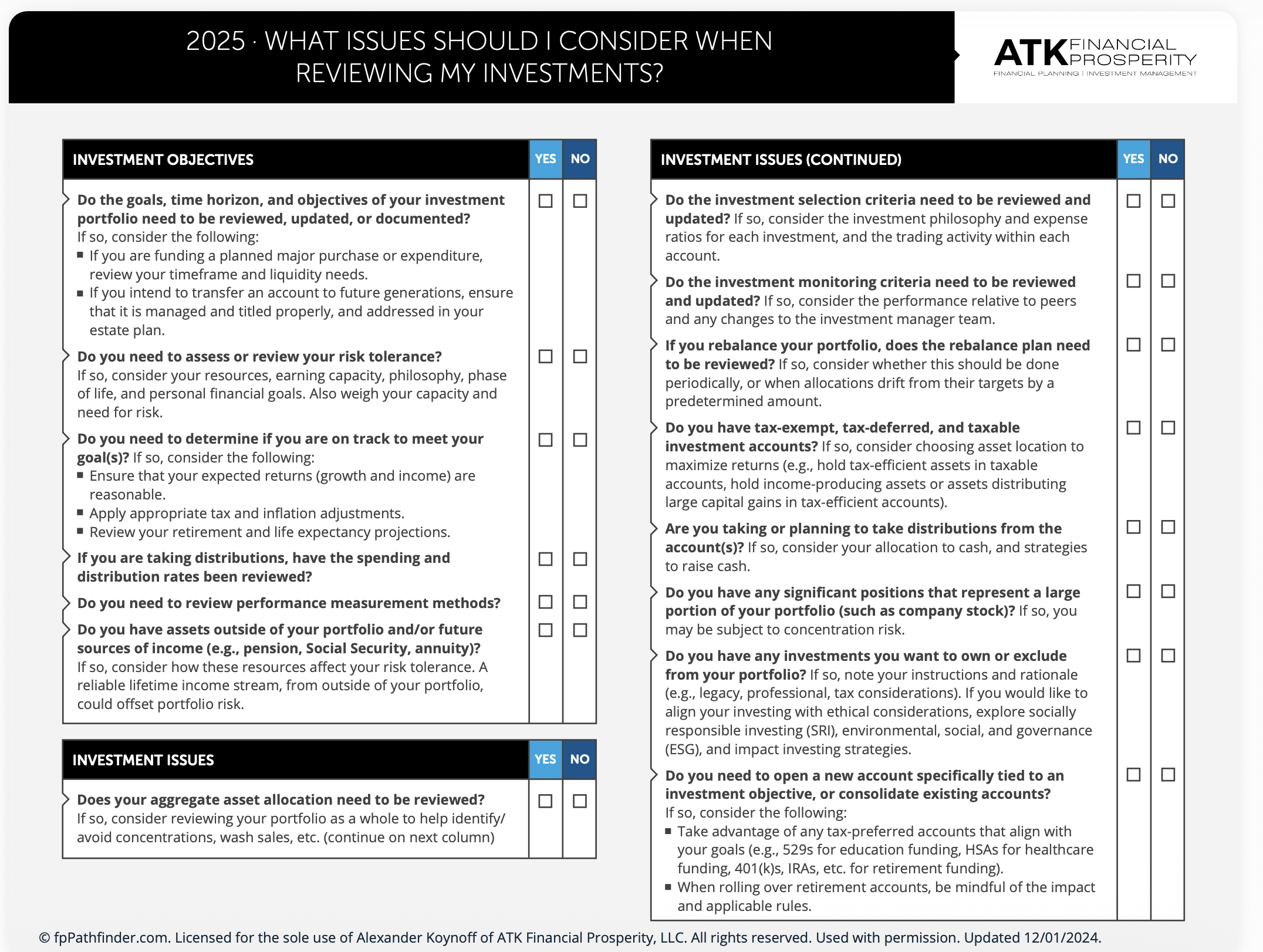

📑 Don’t miss to download the Investments Review checklist at the bottom of the blog. No email required!

2025 has been a very volatile year for the stock market. Many feel uneasy and are wondering if they should get out of the stock market in anticipation of a stock market drop (or a crash).

But is 2025 unique? Depends on how you look at it.

Every day and year is unique. There is always something happening in the world that hasn’t happened before.

But there is one thing about the stock market that happens all the time and is not unique. That’s Volatility! Now, to be clear, the reasons for the volatility are unique, but volatility as a feature of the stock market is not.

What is volatility?

Simply put, it is the ups and downs of a financial instrument, such as stocks. (there is a more nerdy explanation, but no reason to go there for this blog.)

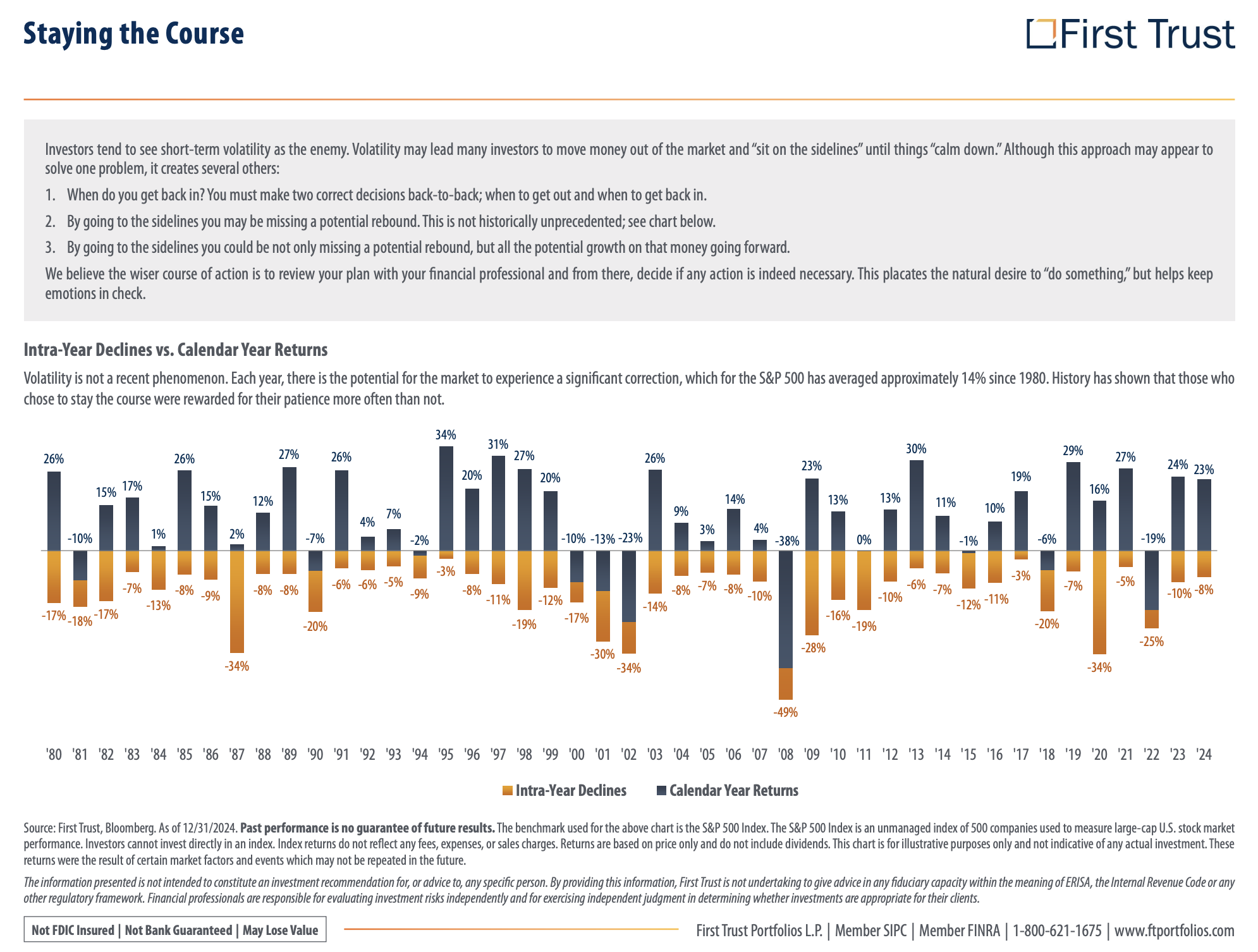

Take a look at the graphic below from First Trust.

Nearly every year, the stock market drops by double digits, as shown by the gold-colored bars in the graph. These drops happen at some point during the year. These drops make investors uneasy.

The dark blue bars represent the year-end return of the stock market, as shown in the graphic. (Using S&P 500 as the proxy).

Year 2020, for example. The stock market dropped 34% due to the uncertainty of COVID-19. But that year, the stock market ended with a positive 16% return. That’s a range of 50%! That is a big swing! That’s high volatility right there!

When events are happening in the world, especially major ones, volatility tends to spike. The stock market hates uncertainty. That was shown yet again in April 2025 when the market reacted to the tariff announcements. The S&P 500 dropped nearly 20% within one month.

During April 2025, I saw many getting anxious. As I was browsing personal finance forums and Facebook groups (I do this daily), I could sense the fear. People want to get out of the market because “this time is different”.

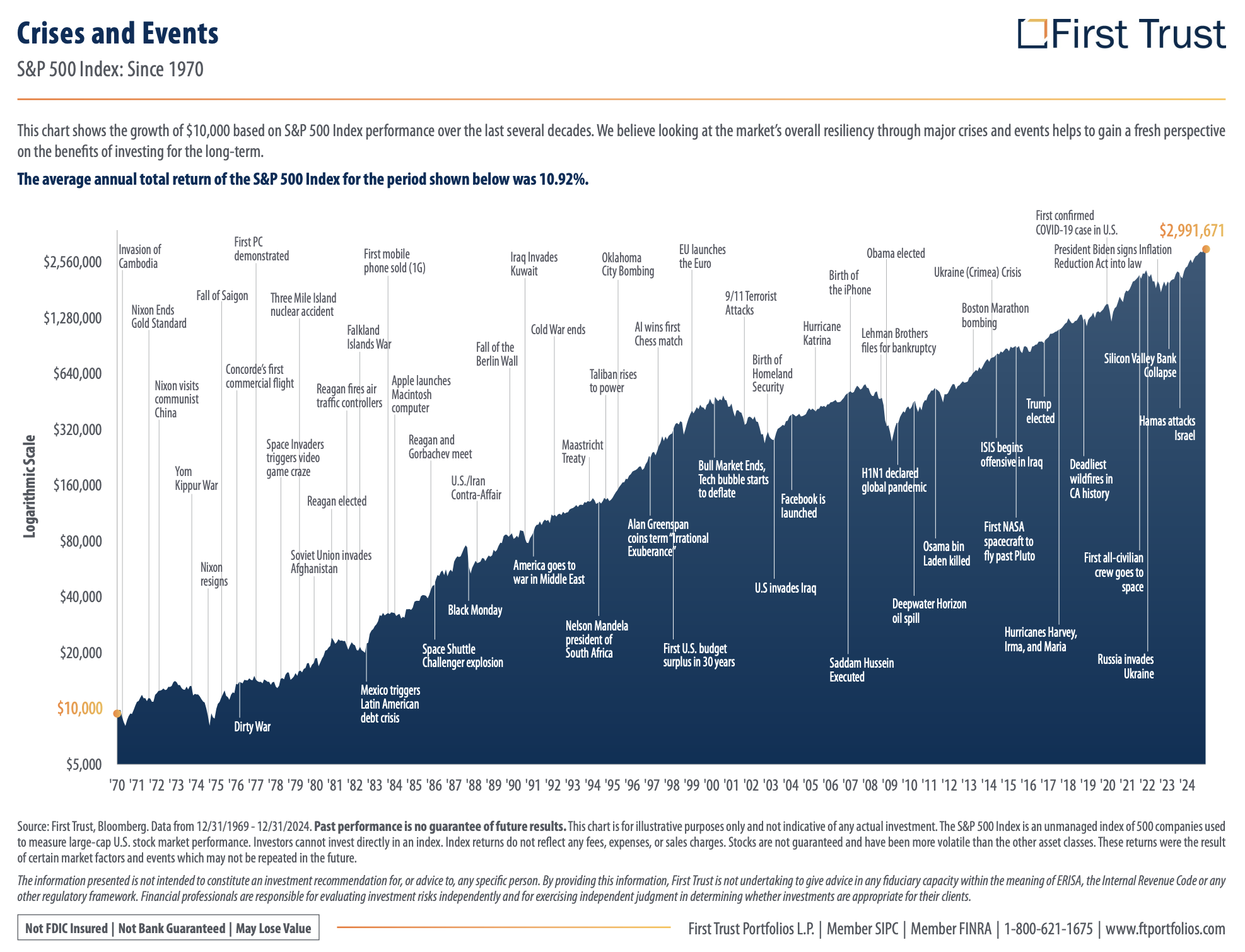

But it is always different. There is always a reason to sell. Take a look at the “Crises and Events” graphic below.

And the media loves times of crises and major events. They will sell as much fear as possible. Fear is what generates clicks and views. Fear inducing headlines, using bold colors and letters, etc. Whatever stirs emotions and makes you read/watch their material.

So when should you get out of the stock market?

When will the market drop? When will be the next big decline?

There is only one correct answer. That answer is “We don’t know!”

There are companies with millions and billions of dollars in resources, researching and digging into data that may impact the stock market. They fail to predict what the stock market will do all the time. They may get lucky here and there, guessing what the market does, but overall, they cannot consistently predict the market.

Let’s say you get out of the market, and by sheer luck, you time it perfectly. You get out right before the market drops. You are feeling great about your decision.

But now, you have to get lucky again. When will you get back INTO the market?

Trying to time the market is a dangerous game. Chances are, you will end up with less money compared to just spending time in the market and follow a financial plan. There is a saying in the financial world. “It is not timing the market, but time in the market.”

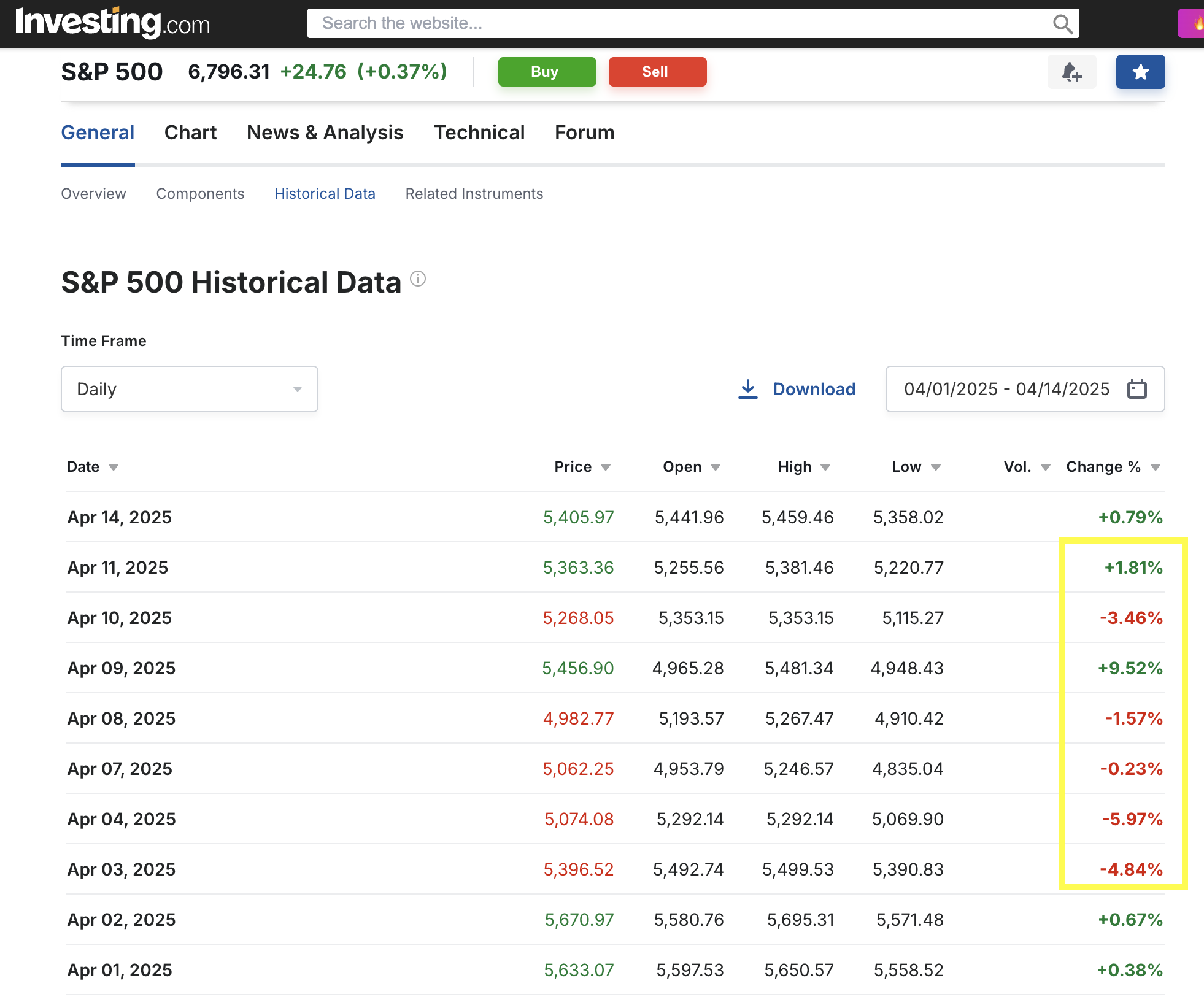

See graphic below.

Missing the best days in the market can cost you a lot. Being out of the stock market, and sitting in cash can expose you to miss days where the stock market goes up a lot.

You may be asking yourself, “but what if I also miss the worst days as well?”

Well, sure, but how will you know when the best days and the worst days for the stock market will be? You will need a crystal ball for that. 🔮

And from historical research, the best days of the stock market often happen close to the worst days of the stock market.

Here is a very recent example that happened during the April 2025 market fiasco.

Take a look below. The U.S. stock market (represented by the S&P 500 in this case) was in a frenzy. Two huge back-to-back negative days on April 3rd and 4th. What if you got out then? You would have missed the 9.52% increase that happened on April 9th.

I’ll say it again and again. Timing the market is very very very hard. The stock market is the collective thoughts and emotions of every trader and investor out there, including yourself. Everyone has their own emotions and opinions about what is happening in the world on any given day. That’s what makes the stock market so hard to predict, especially on a consistent basis.

What can you do instead of getting out of the stock market?

Get a Financial Plan!

Your financial plan will tell you how you should allocate your investment portfolio. It will also help you stay rational when the stock market is not.

Too often, I see investment portfolios done BEFORE a financial plan is put in place. And I get it. Investments are the sexy part of financial planning.

But if you don’t understand all the other moving parts, how can you buy investments that are aligned with when you will need the money?

How does having a Financial Plan help?

We first need to discuss your financial goals. That’s important because we need to understand where you want to go. As the saying goes, “If you don’t know where you are going, any road will take you there”.

By doing that, it helps us map out your cash flow. It answers the question: When will you need the money? The goal is to align your investment portfolio with the time horizon of when you will need cash.

Now that we know your goals and when you will need money, we can start bringing investments into the conversation, combined with risk management, social security, and tax planning. (yes, lots of moving parts to consider.)

Here is an example:

Let’s say you are 2-3 years away from retirement and you will need to rely on your investments for some of your income. Knowing that, you don’t want to have all of your investments in stocks. Stocks can have big swings, especially in the short term. You need some money in more stable financial instruments. How much of those stable investments? 1 year’s worth? 2? 10? That’s also part of the conversation when we are discussing your financial goals.

Throughout the discussions for this example, we establish that based on your needs and peace of mind, you need five years’ worth of stable financial instruments. (for your unique situation, you, the reader of this blog, that could be two years, zero years, seven years, etc. It is truly personal and situational.)

Having the five years as in the example above, plus social security, based on historical data, personal preference, and ongoing financial planning, that should give you the peace of mind and money needed to withstand stock market drops. You have a bucket of money that is stable. We have developed a cash flow plan outlining how we are going to fund your lifestyle, year by year.

It is done proactively, knowing that the stock market will drop at some point. We just don’t know when, but we are prepared as best as we can be. That’s part of risk management. We review the financial plan on a regular basis (minimum 1-2x a year) and we make adjustments as needed.

But why can’t we just get out of the market and stay out of it forever?

You can do that. Nobody is stopping you.

But know that you will expose yourself to what I call the silent tax.

Inflation has the power to destroy wealth. It happens slowly over time. You don’t feel it at first, but the purchasing power of your money goes down and down.

If we use 3% average inflation, in 25 years, it cuts the purchasing power of a dollar in half. Said another way, if you have $1 today and don’t invest it, in 25 years you will still have that $1 bill, but you will be able to buy half the stuff with it. What costs $1 today will cost $2 in 25 years due to inflation, using 3% inflation.

While cash feels very safe today, it is very risky over a long period of time due to inflation.

While stocks feel very risky today, over a long period of time, based on history, they are safer than cash, as they have beaten inflation.

So, we need to invest. Investing carries risk. But so does not investing. It is a delicate balance that needs to be customized to your life. That’s why Financial Planning is so crucial.

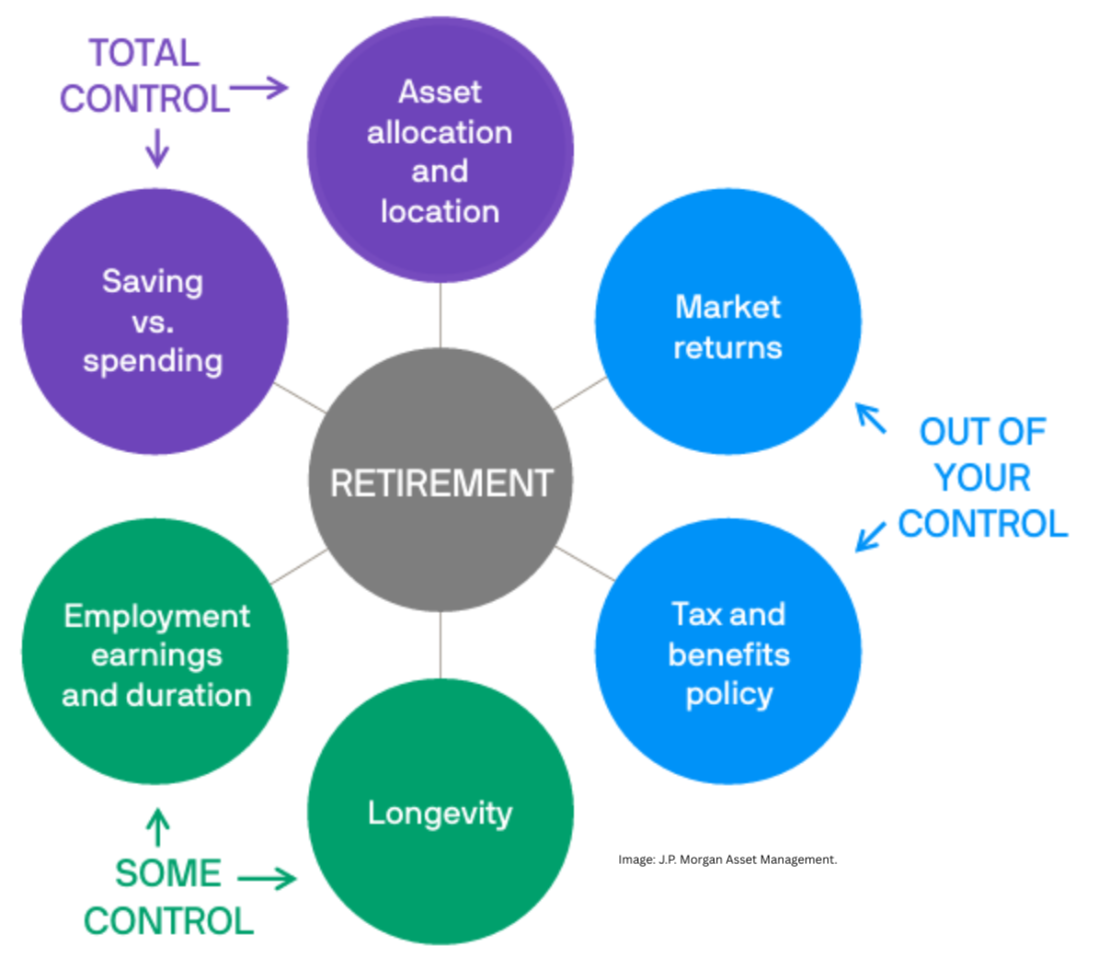

Focus on controlling the controllables.

Don’t let the media bring you down. Fear sells, but your Financial Plan can help you minimize the noise, so you can focus on what matters.

Parting thoughts…

The example I used above was for someone who was about to retire, but the framework applies to any age, whether you are 40 years away from retirement, 10 years away, or already retired.

You need a Financial Plan. A plan that maps out when you will need the money from your investment portfolio.

We have established that we cannot time the market consistently. Getting in and out at the right time is extremely hard, if impossible. Professional financial companies with far more resources and information than us cannot do it.

We also know and should expect that the stock market will drop many times throughout your lifetime. We just don’t know when.

We need to shift our focus to the things we can control and manage.

At a minimum, do this, whatever your age is:

Understand your goals

Map out your cash flow needs

Be proactive in managing risk (we cannot avoid risk, but we can manage some of it)

Align your investment portfolio with your goals and cash flow needs

Focus on what you can control and enjoy your life

The above items are all part of a Formal Financial Plan that should be reviewed at least 1-2x a year. Notice I said Formal, because not having a formal financial plan is still a financial plan. Just not a very good one.

📧 If you are unsure how to start a Financial Plan or if you want to check that you are heading in the right direction, feel free to reach out.

🗓️ The first two meetings are complimentary and you will walk away with clarity. You can schedule a meeting by clicking on my calendar here.

Feel free to review the Planning Process page to get familiar with what we offer.

Located in Oswego, IL, we serve Naperville, Yorkville, Plainfield, Chicagoland, and nationwide.

The blog is for informational and educational purposes only. Past performance does not guarantee future results. Not to be considered advice. Consult with a financial professional for your specific situation.